PCI Security Standards Overview

Our PCI Security Standards

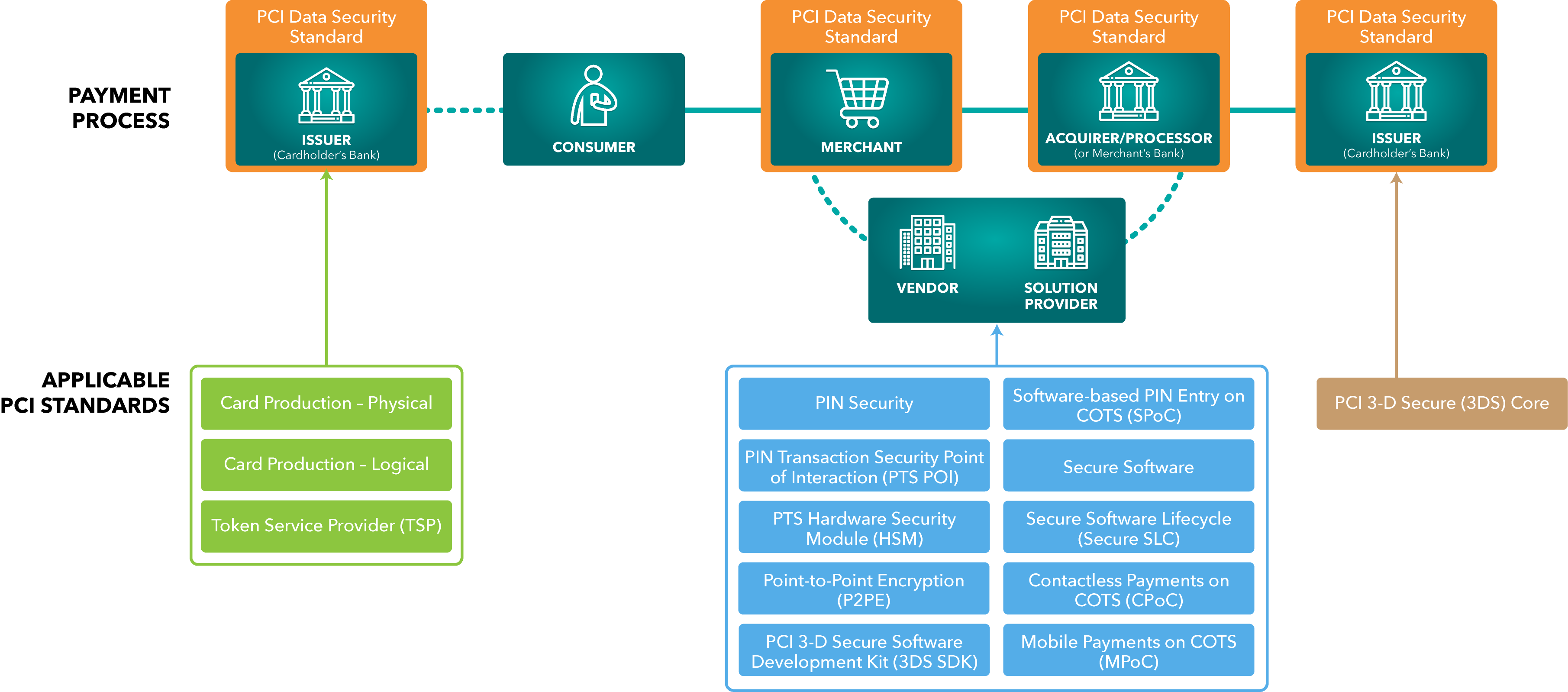

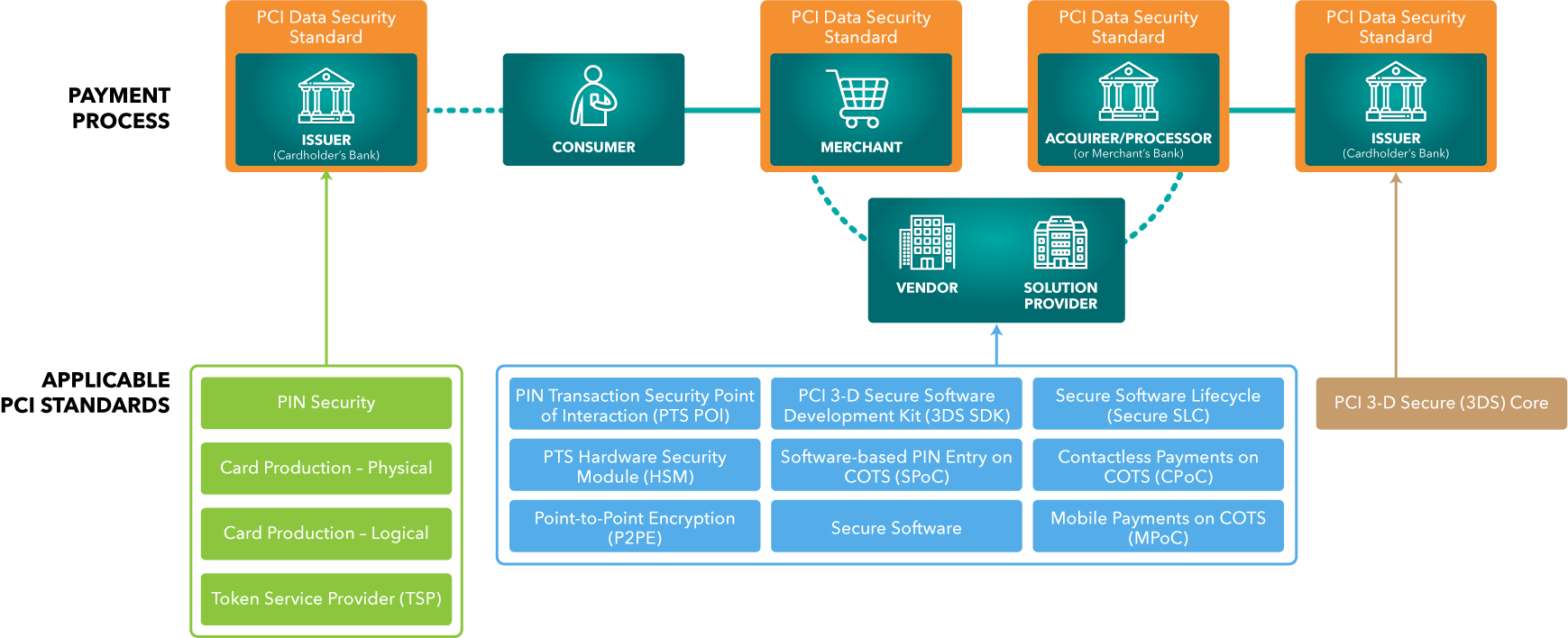

PCI Security Standards are developed and maintained by the PCI Security Standards Council to protect payment data throughout the payment lifecycle. The different PCI Standards support different stakeholders and functions within the payments industry.

Some of the PCI Standards are intended for use by organizations involved in payments, such as merchants, service providers, and financial institutions, to use within their own environments. These standards support the implementation of secure practices, technologies, and processes within the organization.

Other PCI Standards are intended for developers, technology vendors, and solution providers wishing to demonstrate that their product or service was designed with security in mind and meets a defined set of security requirements. These standards support the validation and listing of products and services that meet the standard and validation program requirements.

All PCI Security Standards are developed in conjunction with a global network of payments industry stakeholders.

The PCI Security Standards Ecosystem

This diagram notes applicable PCI Security Standards. Contact payments brands for any related compliance programs.

The PCI Security Standards

PCI Data Security Standard (PCI DSS)

The PCI DSS defines security requirements to protect environments where payment account data is stored, processed, or transmitted. PCI DSS provides a baseline of technical and operational requirements designed to protect payment account data.

Point-to-Point Encryption (P2PE)

Secure Software

The PCI Secure Software Standard defines security requirements for software vendors and developers to ensure that payment software is securely designed and managed, and the integrity of payment transactions and the confidentiality of payment data that is stored, processed, or transmitted in association with payment transactions is protected.

Secure Software Lifecycle (Secure SLC)

PTS Point of Interaction (POI)

Token Service Provider (TSP)

The Token Service Provider (TSP) Standard defines security requirements for Token Service Providers (TSPs) that generate and issue EMV payment tokens, as defined under the EMV® Payment Tokenisation Specification Technical Framework.

PIN Security

Card Production and Provisioning - Logical

This Standard defines the logical security requirements for the development, manufacture, transport, and personalization of payment cards and their components.

The Card Production and Provisioning Logical Security Requirements are complementary to the Card Production and Provisioning Physical Security Requirements.

Card Production and Provisioning - Physical

This standard defines the physical security requirements for card production and provisioning functions.

The Card Production and Provisioning Physical Security Requirements are complementary to the Card Production and Provisioning Logical Security Requirements.

PCI 3DS Core

The PCI 3-D Secure (3DS) Core Security Standard defines security requirements to protect environments where specific 3DS functions are performed, to enable secure consumer authentication for e-commerce and m-commerce purchases.

PCI 3DS SDK

Mobile Payments on COTS (MPoC)

Contactless Payments on COTS (CPoC)

Software-based PIN Entry on COTS (SPoC)

PTS Hardware Security Module (HSM)

The PIN Transaction Security (PTS) Hardware Security Module (HSM) Standard defines security requirements for characteristics and management of hardware security modules throughout their lifecycle, to ensure confidentiality and data integrity during activities such as financial transactions and payment card personalization.

Intended Audience

Payment Application Data Security Standard (PA-DSS) – Retired

The Payment Application Data Security Standard (PA-DSS) is retired as of 28 October 2022 and has been superseded by the Secure Software Standard and the Secure Software Lifecycle Standard.